Experts in some parts of the world believe that globalization has stalled. For example, the prominent Spanish journalist, Ignacio Ramonet, argues that the “course of globalization appears to be suspended”. Based on inconformity in certain European countries, he affirms that more and more people are speaking of “de-globalization”(1).

I think this diagnosis is flawed, and, quite the contrary, globalization continues apace. This is no minor issue, since the choice of proposals or actions differs depending on whether globalization is retreating, stalled or moving ahead.

In many industrialized countries it’s true that the crisis has been severe, but the course of globalization must be evaluated on a planetary scale and not just on what happens in a single region. In various parts of Latin America, from a conventional economic viewpoint, these same years are seen as a boom. A dispassionate look at the typical processes of globalization indicates that they continue apace.

Trade and the Global Economy

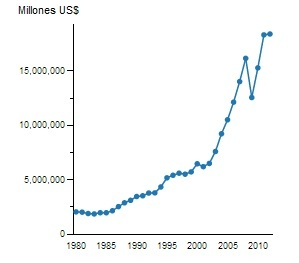

Looking at world trade performance, we find that the value of exports tripled in the period between 2000 and 2012 (even taking into account the 2009-2010 drop). The growth rates were higher than global production growth: in some years the ratio of goods exported to GDP went above 25%, rising above 30% when trade in services is factored in. Further, taking 1980 as the reference year, the growth is even more dramatic, as illustrated by the chart accompanying this text.

Many industrial supply chains now have links spread across several countries, further increasing the need for the rise in international trade. This is possible since, among other factors, transport costs still remain comparatively low.

An examination of globalization’s institutional framework implies recognition that the World Trade Organization (WTO) has lost the overwhelming thrust it had in the past, and that it failed to conclude a quasi-eternal round of negotiations. That said, WTO agreements and regulations remain in effect; large companies take full advantage of them and regulation enforcements are repeatedly applied across multiple nations. The most striking changes in these institutions themselves are not so much the outcomes of attempts to transform them, but changes in the actors that come to its defense. This is the case of Brazil for example, which, under a progressive government, has become a pillar of support for the WTO. In fact, the current Secretary General of the organization, Roberto Azevedo, is Brazilian.

This interchange of actors is also evident in the International Financial Institutions (IFIs). China’s role in the World Bank and the IMF, in which it emerged from a long period of silence to gradually take on the role of protagonist is a good example. A reflection of this change was the choice of the Chinese economist, Justin Yifu Lin, as a vice-president and chief economist of the World Bank.

In the specific case of Latin America, the various drives toward further trade liberalization are not only played out in the corridors of the WTO, but in a slow revival of Free Trade Agreements (FTAs). The Pacific Alliance FTA includes a large number of Latin American countries: Chile, Colombia, Peru, Mexico and Costa Rica, and other nations have aligned themselves as associates, including Atlantic countries such as Paraguay and Uruguay. (2)

Progressive governments now appear even more divided when it comes to these types of agreements, and this is why they’re considering restarting Free Trade negotiations with the European Union. This is the case both with Andean countries (surprisingly, even including Ecuador) and MERCOSUR, where the greatest interest springs from Brazil and Uruguay. Integration projects across the South American subcontinent—such as UNASUR—have failed to carry out agreements on trade, and instead continue to act primarily as a political forum.

These and other facts indicate that globalization not only hasn’t stalled, but, on the contrary, seems to be accelerating. Applying the concept of “hyperglobalization”, proposed by Arvind Subramanian and Martin Kessler (Global Citizen Foundation 2) is appropriate. They use this term to describe a rapid increase in integration, understood in terms of international trade. Subramanian and Kessler also indicate six other characteristics of contemporary globalization: dematerialization, such as the increasing trade in services as compared with goods; political democratization (in form at least); increasing homogenization between imports and exports and also in capital flows, across an increasingly large group of nations; the emergence of a commercial giant on a planetary scale (China); the proliferation of regional trade agreements; and the reduction of barriers to trade in goods but their persistence in services.

Certainly there are many aspects of this description that can be debated, but the first attribute, as described by the term hyperglobalization, reflects the current reality.

The Distinct Faces of Globalization

Taking the previous arguments as a basis, the question is why some European analysts argue that globalization is stalling. I believe that their confusion is a result of at least two factors. There are those who argue that the economic and political crisis in Europe represents a break in globalization, but that is a very Eurocentric stance and one need only recall that when we, in Latin America, suffered not one, but several similar crises, few spoke in terms of “stalled globalization”.

And we can’t forget that crises are themselves integral components of the current form of globalization. This can be noted in the reorganization of international capital, and of patterns of consumption, in access to natural resources–all aspects of global capitalism. Put another way, this type of hyperglobalization always requires some ‘crisis’ in some corner of the planet. It is not an unintended consequence. Crises are inherent to this economic dynamic.

I am not denying there’s a crisis in its multiple expressions: economic, social, political and ecological. What I would argue is that this does not imply that globalization is stalling or reversing, rather it is a symptom of its continued march. This is a globalization that promotes benefits for some while leaving others submerged in acute crisis.

Let’s briefly review some of these current readjustments as they happen. As the crisis chiefly affected industrialized countries, a significant portion of capital that would previously have been invested there, now flows south. Also, as the crisis also generated uncertainty and volatility, many investors put aside industrial or services ventures, focusing instead on sectors they considered to be safer, such as land, minerals, energy or food. Foreign investment in South America, reached 144 billion dollars in 2012, with 51% of this ending up in the natural resources sector (according to ECLAC data). So there are changes in capital flows, both in the countries involved as well as in target sectors.

Meanwhile various parallel changes are underway in international trade. Asian nations, China in particular, have not just become massive exporters, they are also voracious importers of natural resources, and with that they have increased their sales derived from certain sources in Latin America or Africa. Rather than a sustained collapse in global trade, what is underway instead is a substantial change in its underlying structure, with the increased importance of south-south transactions.

Access to natural resources is again becoming increasingly important, and the high price of raw materials has had the effect of even further ‘globalizing’ several Latin American countries as their markets are situated on other continents. The proportion of natural resources in the totality of exports has not decreased in the continent; data from the period 2000 to 2011, shows it has in fact risen from 75% to 87% in the Andean countries, and from 51% to 67% in MERCOSUR. This has resulted in dramatic changes in certain nations. For example, Brazil has become the largest of the extractive economies on the continent. Their mineral extraction almost triples the sum of all other South American countries combined—totaling 410 million tons in 2011—as compared with a total of 147 million for the sum of all the remaining countries.

The global consumption of mineral resources, energy and industrial food production is startling. Estimates indicate that since the beginning of the XXI century, every year between 47 and 59 billion metric tons (3) are extracted. This is a vast figure, which hasn’t stopped growing, and its growth is nearly double that of population growth. Despite these enormous pressures for the appropriation of natural resources, the defenders of hyperglobalization seem incapable of understanding that natural resources are limited, and that the current exploitation levels entail very serious social and environmental impacts.

As can be seen, there is no slowdown or stagnation. Globalization is much more resilient than many might think.

Latin America faced with Hyperglobalization

The situation of hyperglobalization in Latin America is paradoxical. In the past, a broad range of social and political movements took part in intense debates denouncing the planetary impact of its effects. One way or another, they all sought alternatives.

More recently, however, many governments in the region from both the left and the right of the political spectrum have taken advantage of globalization, realizing huge export gains due to the high prices of raw materials. They have received huge amounts of foreign direct investment. These and other factors have led to higher levels of economic growth, which served in some countries to fund important programs, such as those to reduce poverty. In turn, imports have become cheaper and thus spurred a new consumerism, which has also resulted in a feeling of wellbeing (particularly a material one) in broad social sectors.

By these means, in contrast to what has happened in some corners of the United States or Europe, many people in Latin America now view this form of globalization favorably, or at least they do not feel threatened by it. This globalization is so enticing, the prices for raw materials are so high, and demand so sustained, that this has even become a key factor in swinging progressive governments towards postures which are more economically orthodox, with ever more extreme confrontations with civil society.

It is no surprise that, little by little, this would bring many actors—such as politicians or union officials—to abandon their criticism of globalization. They have less interest in seeking alternatives. Moreover, for some, the current global circumstance represents a great ‘opportunity’ for growth that should not be wasted.

Resistance and the search for alternatives to hyperglobalization are still maintained by those who suffer its effects directly, like peasants displaced by exporting agribusiness, indigenous people who must deal with impacts of mining or oil, workers who lose their jobs because of the avalanche of imported goods, or by social militants who manage to see through the contradictions and also the inherent threat of this trajectory.

It is necessary to point out and expose all these contradictions. It is also necessary to emphasize once again that this high-speed globalization is largely sustained by Latin American exports in minerals, energy and industrial food production. The problem is not just the enormous volumes, but also the social and environmental impacts. Governments are so caught up with globalization that they don’t even push to correct the prices of these raw materials, even though the costs (for example, social displacement and pollution) are born by the States themselves. The prices of many manufactured goods are not only comparatively low because of miserable salaries in Asia, but also due to negligible costs in raw materials.

Far from stalling, globalization continues marching ahead. To confront it, we need to reactivate and rebuild our critical capacities, to mobilize and to find alternatives, which, as always, lie within civil society.

Eduardo Gudynas is a researcher at CLAES (The Latin American Center for Social Ecology), he blogs at www.accionyreaccion.com and he can be followed on twitter at @EGudynas. He is a columnist for the CIP Americas Program at www.americas.org

References:

1. The course of globalization seems to have stalled, Ignacio Ramonet , “Miradas al Sur” South Facing Perspectives, Buenos Aires, May 19, 2013 ; http://sur.infonews.com/notas/el-curso-de-la-globalizacion-parece-estar-detenido .

2. English Site for Pacific Alliance Trade Group: http://alianzapacifico.net/en/

3. Subramanian, A. y M. Kessler. 2013. The Hyperglobalization of Trade and Its Future. Global Citizen Foundation, “Working Paper 3” June, 2013; http://www.gcf.ch/wp-content/uploads/2013/06/GCF_Subramanian-working-paper-3_-6.17.13.pdf .

4. Decoupling natural resource use and environmental impacts from economic growth. 2012. United Nations Environmental Programme.

Translated to English by Tony Phillips and Ailin Liberman Ares

REFERENCES:

[1] English Site for Pacific Alliance Trade Group: http://alianzapacifico.net/en/