By Tony Phillips

In 2019 Argentina’s future tweeter-in-chief, Javier Milei, was a mere deputy in Congress when he tweeted:

“Public debt is immoral. It finances a ‘feast’ of public expenditure by generations that not only haven’t voted yet; some may not even have been born. By this process the current generation steal the income of future generations. In short, a government that takes on debt can never be [libertarian]” September 14, 2019

Fast-forward less than half a decade and Javier Milei is now president and facing his first mid-term election in October 2025. Now Milei now wants more International Monetary Fund (IMF) debt for his libertarian Argentina, not less. Who shall feast on this new debt this time?

Argentina’s economics minister Luis Caputo headed up Argentina’s Central Bank in 2018, under president Mauricio Macri (with Donald Trump in his first presidential term) when the IMF loaned Argentina about $50 billion dollars. Now in 2025, under President Javier Milei (with Donald Trump in his second term as US president), Milei and Caputo are seeking an additional $20 billion from the IMF. This despite the fact that most of the IMF debt, taken on under Macri, is as yet unpaid. Milei seems to have completely abandoned his critique of public debt as “immoral”.

When the IMF is serious about rebuilding a nation’s finances it applies conditions to loans, setting rules as to what that new debt can and will be used for, thus preventing governments from spending it on short-term priorities such as winning mid-term elections. If anonymous sources speaking to Bloomberg are correct, such conditionalities will not be imposed on Argentina for a new $20Bn. The IMF apparently has not even prioritized repaying Macri’s IMF debt. As it stands, even without new IMF debt scheduled debt repayments to the IMF in the next five years are already $14 billion.

As with the Macri loan in 2018, the IMF often makes lending decisions that are more political than financial or economic. This new debt deal, if the IMF board allows it to occur, will be more about mid-term election results than the long-term stability of the Argentine economy.

The US factor

Based in Washington DC, the IMF is controlled by its chief stakeholder, the US government and never generates a loan without checking with the US Treasury. In the case of Argentina, the IMF seems set on masking the reasons behind Milei’s debt request and the real problem behind Argentina’s financial straits. That problem, under Macri in 2018, and under Milei in 2025, is the instability of the Argentine currency, constantly suffering internal pressure to devalue coming principally from commodity exporters paying taxes and salaries in devalued Argentine pesos while earning US dollars abroad.

While discussions continue between IMF analysts and Milei and Caputo, it’s instructive to look at Argentina’s past with the Fund, and especially what the Macri-Caputo government did with the first $50 billion in debt from the IMF in 2018-2019. Many of the same people were involved then as now, including Trump in his first presidential term, Macri as president of Argentina, and Caputo in the Argentine Central Bank.

A history of IMF instability

Argentina tried to deal with an unstable currency in the 1990’s when it funded (and, for a decade, held) a one-to-one peso-to-dollar fixed currency exchange. In 2001 the Argentine peso collapsed out of this managed currency regime, and fell first to 3 pesos to the dollar, then 4:1. By Macri’s presidency 45-50 pesos bought a dollar and now under Milei the ratio is 1000 pesos to the dollar.

When the Argentine economy collapsed in 2001, banking customers lost their deposits, security forces in the streets of Argentina’s cities killed 37 protestors and there were five presidents in a week. Argentina had the largest default ever until Greece in the Euro crisis nearly ten years later.

In 2018-2019 when Argentina last borrowed from the IMF, the stated justification was to stabilize the currency. Macri and Caputo failed to stabilize the peso against the dollar and bled through many borrowed IMF billions, effectively subsidizing the profits of currency speculators with borrowed debt from the IMF. Argentina still owes the IMF at least $44 billion from that time.

Caputo’s handling of the IMF debt in 2018, was criticized in an interview with Mauricio Claver-Cardone published under the title “Milei must learn from his mistakes because if he fails they will blame Trump”. The former chairman of the Inter-American Development Bank (IDB), who was later run out of his position in a scandal and is now Trump’s Special envoy for Latin America, described Caputo as a financier and not an economist. Claver-Cardone noted that Caputo lost the first IMF disbursement (14 billion) “to the markets”. Caputo lost this job before Macri lost the next election, but he’s back again.

While speaking to a Miami financial forum in 2024, Claver-Cardone called this kind of lending to pay back previous loans “an international Ponzi scam”. The entire $50 billion-dollar IMF disbursement was consumed by 2019 when Macri lost power in trying the stabilize the currency. Since Macri, reserves dropped by half during the government of Alberto Fernandez with the pandemic.

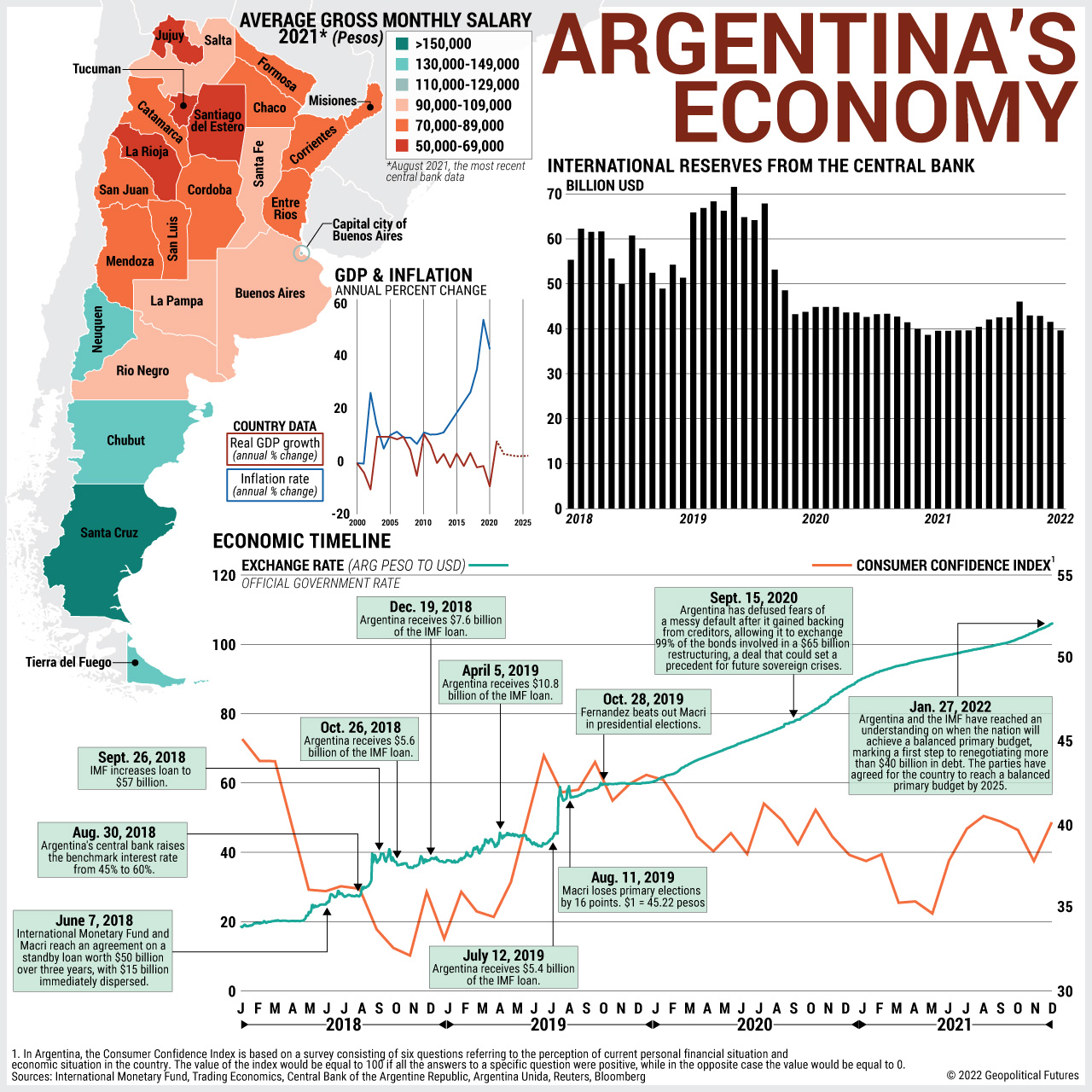

That first disbursement of the IMF fifty-billion-dollar loan received on June 7, 2018 can be seen in this graphic from GeoPoliticalFutures. By the time Macri finished his term, the rest of that loan was used up too. The reserves never recovered.

Now the new kid on the block is Javier Milei, who even with a possible large new infusion of freshly borrowed IMF dollars, still faces a highly unstable currency with internal prices that make Argentina uncompetitive. Milei has refused to make public his justification for seeking more IMF debt that will burden Argentina for generations to come. Both Milei and Caputo know that sharing such information gives currency speculators an unfair advantage even if they face inevitable criticisms regarding lack of transparency. The Argentine congress has formally complained to Milei that it was not informed on the amount of the loan request (or what it would be used for) but Milei’s allies in congress, especially Macri’s PRO party, authorized it anyway.

There is little chance that an uncontrolled devaluation can be avoided this time with an even smaller loan from the IMF, but Milei seems to be betting that a loan will defer the worst till the elections in October. This appears to be the main rationale for the loan request.

The IMF board will meet in April 2025 where they plan to make a decision on Milei’s request. To accept the request, the IMF board will be required to break their own internal rules again for Argentina by adding to the debt of a nation whose current debt is way above IMF limits for such a small economy. Overriding these rules requires “exceptional access procedures” requiring board approval.

An uncertain future

Even with Milei’s cruel “adjustment” -closing government departments, laying off tens of thousands of government employees, reducing pensions, and slashing education and health budgets, among other measures- reserves are about half what they were in 2019. Something needs to be done, but if borrowing from the IMF to pay the markets did not work back then why borrow more IMF money now?

This is where trust comes in. Always prone to hyperbole (Milei has claimed that will probably one day be given a Nobel Prize in Economics), Milei calls Caputo the “greatest Minister of Economics in history”. So far, Milei/Caputo have presided over one of the world’s most unstable economies, earning Argentina the title of the highest inflation in the world for 2024.

Another Crisis in 2025

Macri is now Milei’s partner in government. He is founder and chairman of the PRO party, the largest voting block allied to Milei’s La Libertad Avanza (Liberty Advances Party). In the 2024-2025 Argentine Federal Parliament, the LLA has 37 seats and PRO supports them with 93 seats, but that will change after the October elections. PRO voted with Milei’s LLA party in congress to authorize the new IMF loan request on March 19.

Macri and Caputo tried to stabilize the Argentine peso with a new IMF loan, they failed. The next presidency under Fernandez failed too, but without increasing the debt and instead raising taxes (including a small wealth tax) during the pandemic. The wealth tax, though miniscule, caused ructions in the landowning classes in Argentina.

The problem of repaying Macri’s IMF debt falls now on Milei who in a reversal now considers it morally acceptable to borrow sink the country further in debt and kick the can down the road.

Milei’s doomed plan to stabilize the Argentine economy

The big question for economists is: Can another IMF loan serve to stabilize the currency in 2025? Milei’s economic policies in his first year in power have never really been libertarian. Milei argues for something like Thatcherite monetarism, but monetarism is, arguably, impossible with current Argentine interest rates over 100% a year and rising, not falling.

Milei defers in matters of running the financial economy to Caputo who is a dyed-in-the-wool neoliberal. Caputo plays the game by market rules. He and the IMF use the same playbook of bond issuance, sterilization and carry trades. All of these are neoliberal measures designed to control inflation, none of which have worked in Argentina to date.

Whether the IMF decides to subsidize Caputo’s plays again (with no strings attached) remains to be seen. IMF directors will have to decide whether they take the risk of issuing even more debt while possibly enabling Caputo to make the same “mistake” that Milei called immoral in 2019. If Caputo gets another 20 billion, that might give Milei a few months of monetary stability, which could help Milei’s LLA party get more seats in the federal congress and senate in the October mid-term elections. But then what will happen?

The underlying fundamentals indicate they will be another massive devaluation, whether currency controls are removed or not. There is zero appetite in Argentina to control prices or increase competition–Milei is dogmatically against this.

The current situation does not look good. By late March, Milei was burning through a billion to a billion and a half dollars a week in non-productive dollar flight. Much of this is being used to pay international speculators to stay in peso bonds funded by Argentine taxpayers. Some of the disappearing reserves are also going into exporters pockets who receive dollars for 20% of their exports (instead of the equivalent peso value), largely benefitting big landowners, another Caputo innovation. The Central Bank is bleeding dollars and has negative net reserves. Given this situation, Argentina is in no position to pay back the current IMF debt, never mind another 20 billion.

At the time of writing, local Argentine economic analysts seem to indicate that the IMF might require another hard devaluation of the peso. The IMF also wants Milei to get rid of currency controls (locally referred to as the CEPO), but Milei has promised the electorate there will be no more large peso devaluations until the CEPO is eliminated, so he would have to do both simultaneously to keep his word. This would open Argentina up to more, not less, currency speculation. Is Milei really ready to take on this risk just to do better in the October elections?

To the rest of the world Alberto Benegas Lynch Jr. is an ageing CATO think-tank aficionado from Argentina, but to Milei and his libertarian sect he’s a hero. His son Bertie Benegas-Lynch is a conservative Catholic deputy for Buenos Aires in Milei’s party. Alberto also tweeted against Macri’s IMF loan in 2019. Will he be right again?

“The IMF works as a financier of inept government when they are about to renounce their power or under pressure from reality that is about to change their failed statist policies. They receive large quantities of resources at low interest rates with grace periods so as to be able to save their overweight Leviathan” December 8, 2019

Tony Phillips, Argentina, is an Irish ecological economist living in Buenos Aires. He writes about debt, development and the power of finance. He specializes in Ecological concerns for international finance and in Latin American regional integration (MERCOSUR/UNASUR). He is an analyst and translator with the Americas Program. Much of Tony’s work is published at ProjectAllende.org Tony’s most recent book Europe on the Brink can be found here: EuropeOnTheBrink.com .